News

Observing Financial Literacy Month with The Financial Awareness Foundation

HeirMail

By: HeirSearch

With spring’s arrival, we’ve reached an important time for financial introspection and learning: celebrating April as Financial Literacy Month, an annual collective initiative to foster financial stability and literacy among communities across the U.S., and within 5 continents worldwide.

But why is Financial Literacy Month so important? Because it alerts, motivates, and helps educate individuals and families navigate the complexities of managing finances while establishing and keeping their financial, estate, and gift plan current.

Supported by HeirSearch and The Financial Awareness Foundation (TFAF), April is dedicated to bridging gaps and removing barriers to strong personal financial knowledge. Through resources and outreach, TFAF mobilizes its efforts across various sectors to empower people and communities with the financial literacy needed for a secure future. This initiative is increasingly pertinent as many Americans face the challenges of retirement planning and escalating debts.

In this blog post, we’ll explore the goals of Financial Literacy Month and highlight TFAF’s role in championing financial literacy.

The Financial Awareness Foundation: Championing Financial Literacy for All

TFAF spearheads two key initiatives annually under The Improving Financial Awareness & Financial Literacy Movement:

- April – Financial Literacy Month

- October – Estate & Gift Planning Awareness Month

The Foundation addresses widespread financial illiteracy by advocating financial awareness and quality, comprehensive financial education, and adopting wiser money management principles. They aim to equip individuals with the requisite skills to make informed financial choices, achieve their goals, and ensure the thoughtful transfer of assets to future generations, thereby fostering a more financially savvy world.

At HeirSearch, we proudly support The Financial Awareness Foundation’s mission. We encourage legal, finance, philanthropy, non-profit, and education professionals to join this important cause.

Legal professionals and organizations can contribute by engaging their networks, communities, and the media in supporting this effort. The initiative aims to educate, motivate, and assist everyone in efficiently creating and maintaining their financial, estate, and gift plans.

Interested in getting involved? Visit TFAF’s website to learn more about the campaign and the importance of enhancing financial literacy.

Financial Planning: A Lifelong Journey, Not a Destination

Financial planning is a very important life skill that is not commonly taught at home or school that involves setting realistic financial goals, adapting to changes, and preparing for the unforeseen. It’s a process that requires regular reassessment and adjustment as personal financial needs evolve. Factors such as changing economic conditions, tax laws, and investment markets also necessitate periodic plan reviews to ensure ongoing effectiveness.

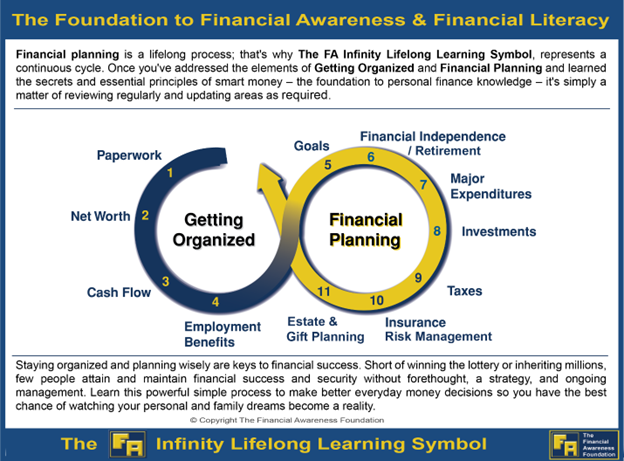

The Financial Awareness Infinity Lifelong Learning Symbol, represented by the infinity sign (∞), symbolizes the continuous nature of financial education and planning. By mastering the basics of financial organization and planning and staying informed on smart money principles, individuals can ensure their financial strategies remain strong even in the face of change.

We encourage you to share this quick financial literacy quiz with your clients and broader network to boost their understanding and engagement with personal finance. You can learn more about The Movement and easy way to participate here, also stay up to date with TFAF by subscribing to their newsletter for direct access to valuable financial resources.

Keys to Financial Success: Be Strategic, Stay Organized

Achieving financial security requires strong intention, careful planning, and continuous management. This approach empowers individuals to make informed daily financial decisions, bringing personal and family aspirations within reach.

TFAF offers a wealth of resources designed to enhance financial awareness and literacy for:

- Individuals and Families – to support informed, lifelong financial decisions and wealth building.

- Financial Service Professionals – enabling professionals to attract informed, motivated clients.

- Government, Employers, & Leaders – aiding in addressing the social challenges of financial unawareness and literacy deficits while stimulating economic growth and reducing welfare dependency.

- Educational Institutions – contributing to the financial education of students, faculty, staff, and alums, thereby fostering a less financially stressed, more productive, and philanthropic society.

HeirSearch: Supporting Legal and Trust Professionals in Fulfilling Their Fiduciary Duties

HeirSearch assists legal and trust professionals mitigate financial risks and fulfill their fiduciary duties. Since 1967, we’ve used forensic genealogy, an analytical research method, to complete tens of thousands of worldwide searches.

Our proven methods support the legal and trust professions in mitigating financial risks for their clients and fulfilling their fiduciary duties. Our fees are always reasonable and based on specific search requirements – we never charge a percentage-based fee.

If you require assistance establishing heirship for legal purposes, we offer no-cost, no-obligation consultations, regardless of whether you plan to initiate a search immediately.

If you need to establish kinship for legal purposes, support is just a phone call away. We look forward to connecting!

Phone: +1 (800)-663-2255

This report is for informational purposes only and is intended only as a reference. HeirSearch does not endorse or recommend any of the products or services offered in the third-party articles or content contained within. We cannot guarantee the accuracy or effectiveness of the same and will not assume any liability related to the same. Additionally, nothing contained herein may be construed as legal advice. All offers are void where prohibited by law. Copyright © International Genealogical Search Inc. All rights reserved.